Double the efficiency of Loan Recovery operation with our AI Powered NPL Management solution, LOAN BACK.

Automate tracking, follow-ups, eradicate manual process, reduce errors, and manage high volume retail , SME & Corporate loans efficiently all in a secured and tailored platform, LOAN BACK.

AI-powered loan recovery automation that simplifies monitoring, compliance, and decision-making. Eases the lives of Loan Recovery team

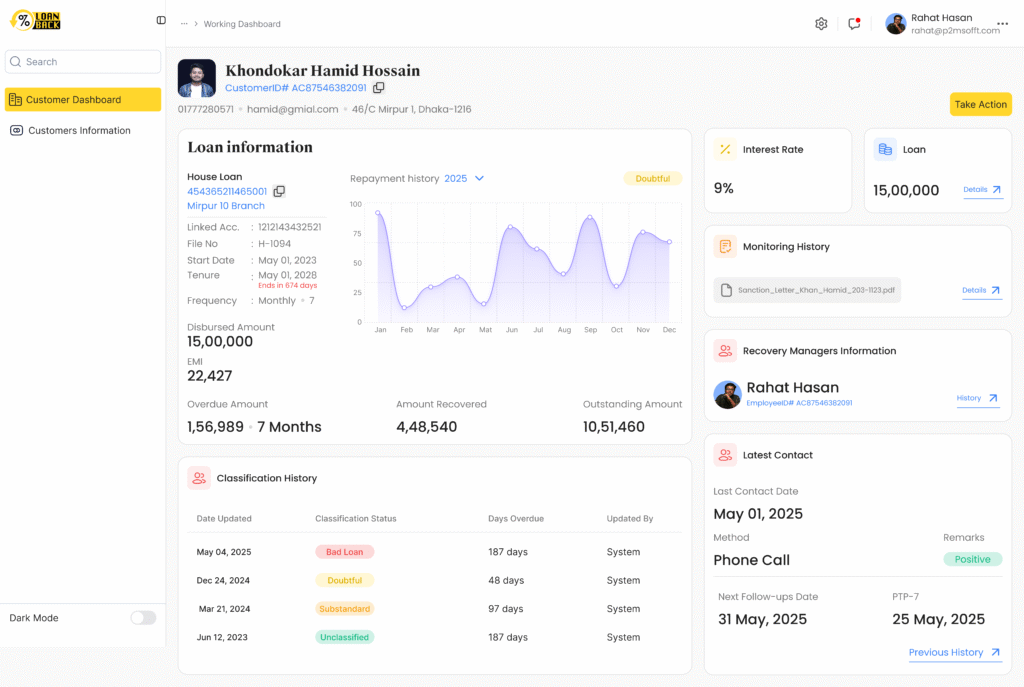

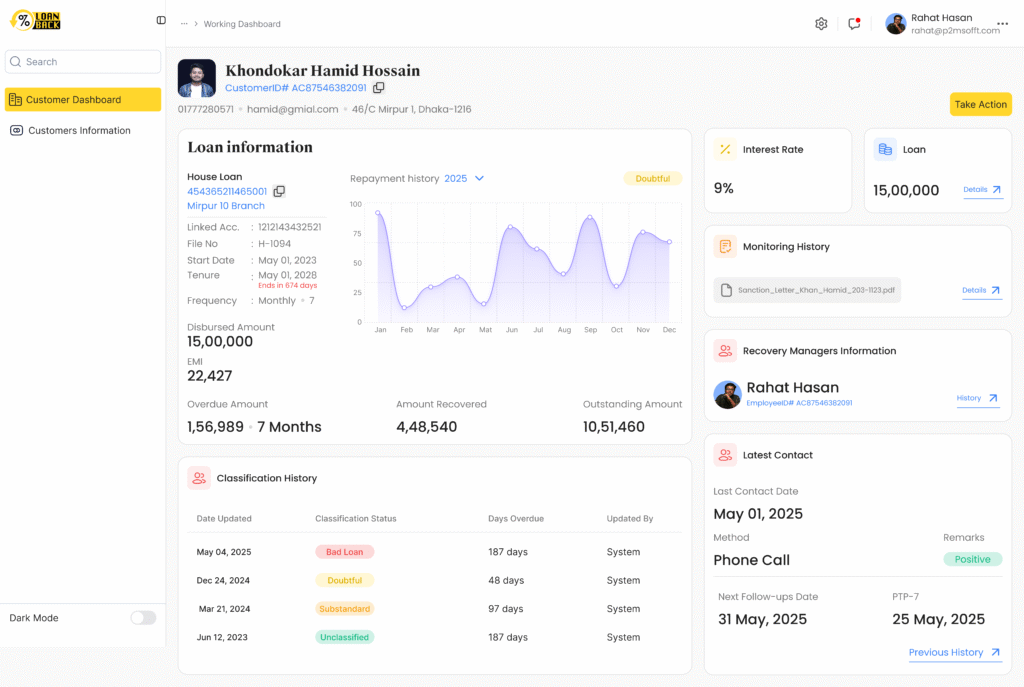

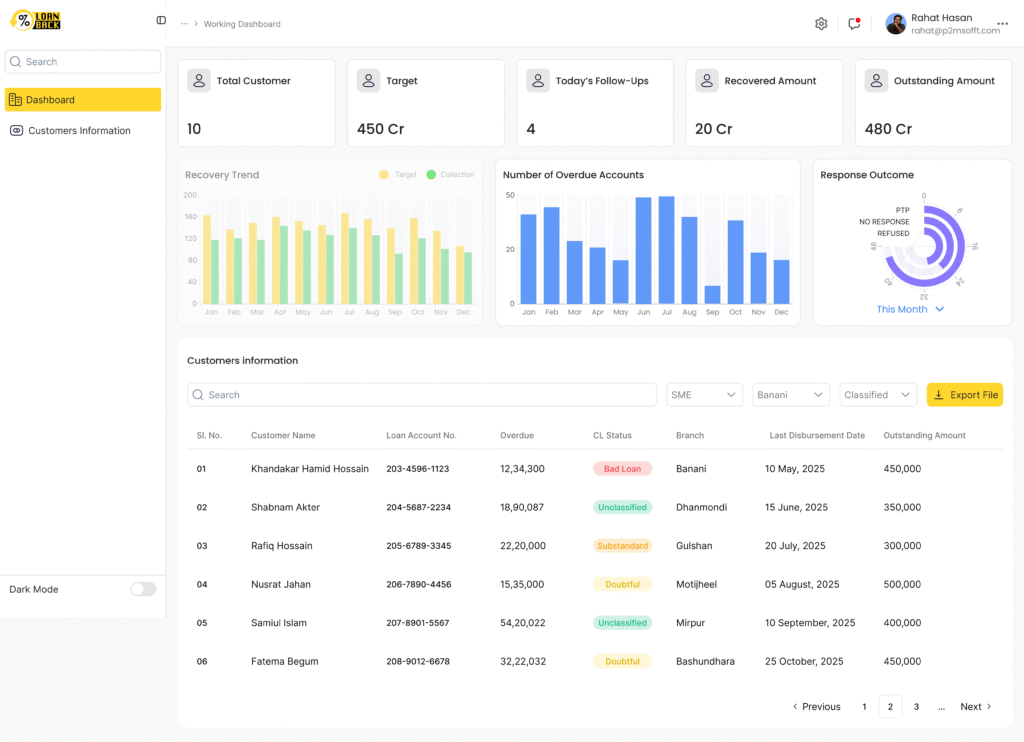

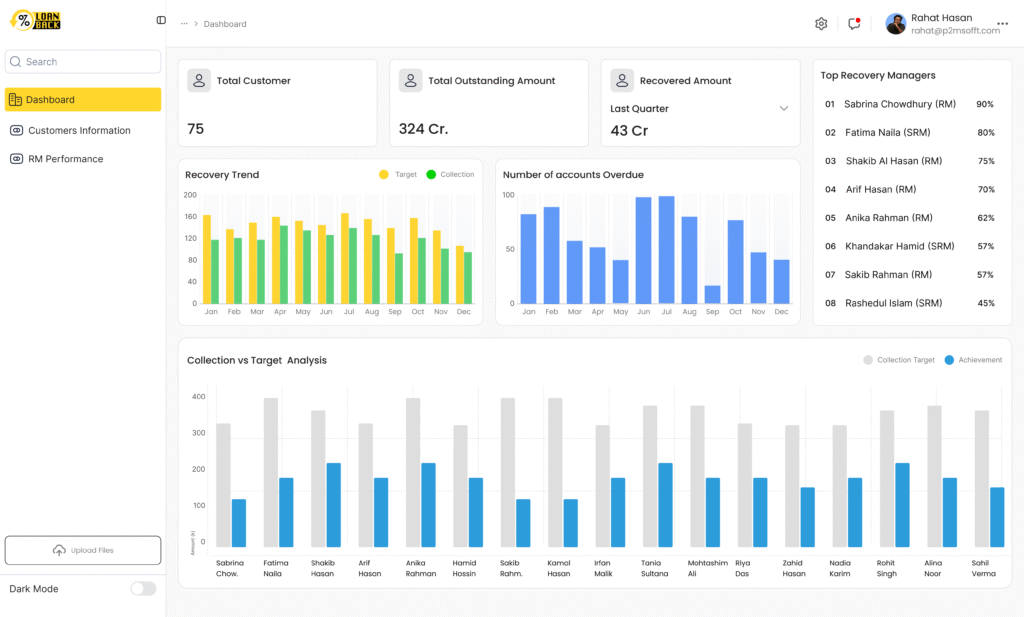

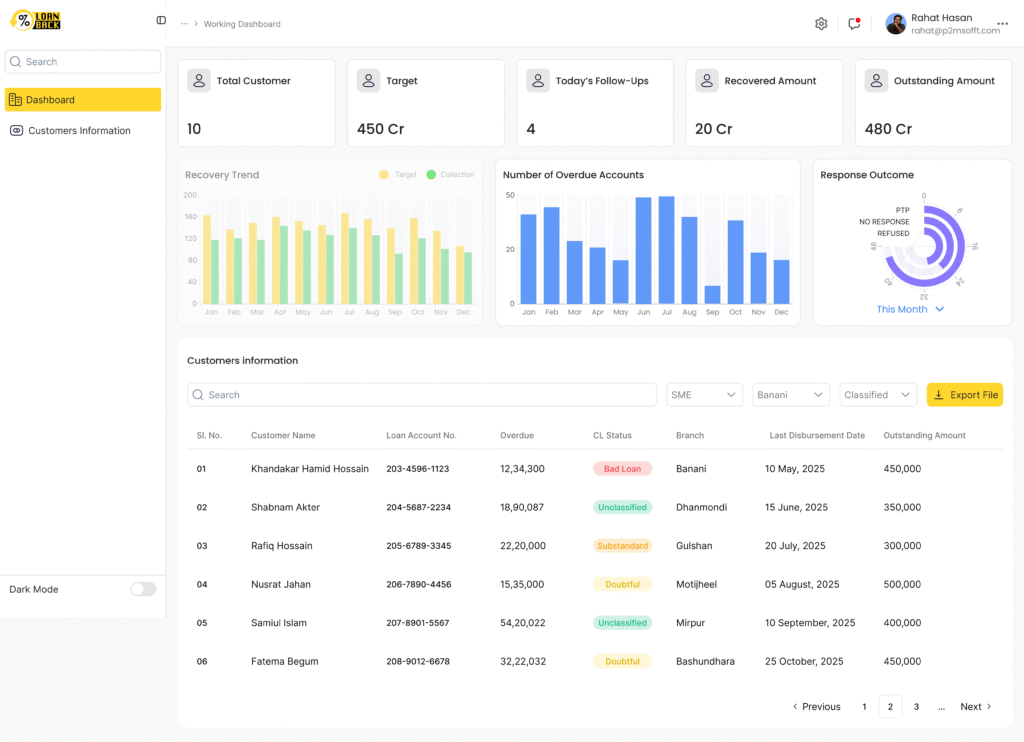

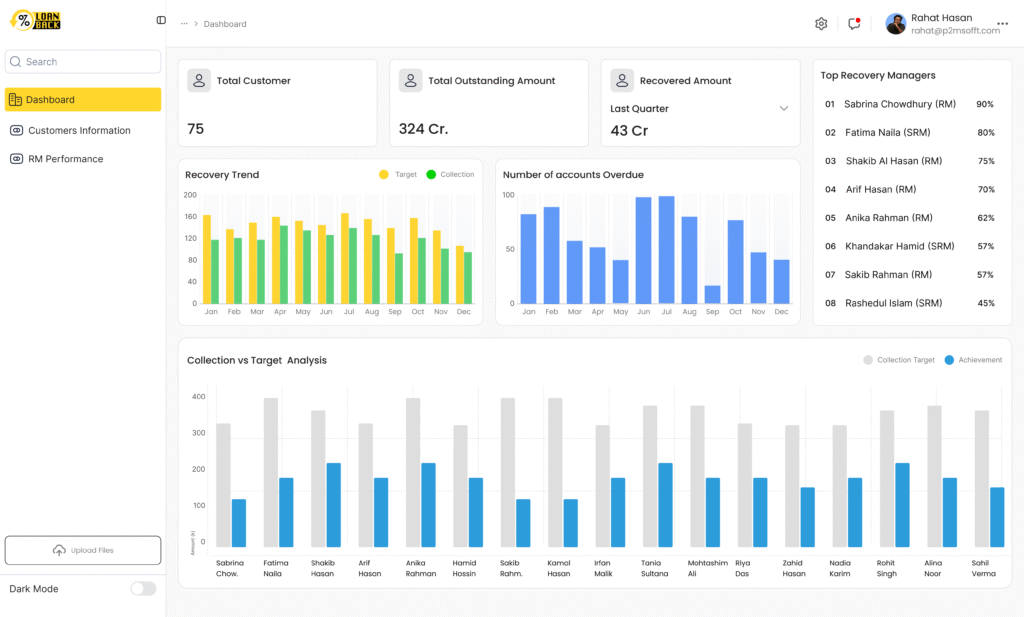

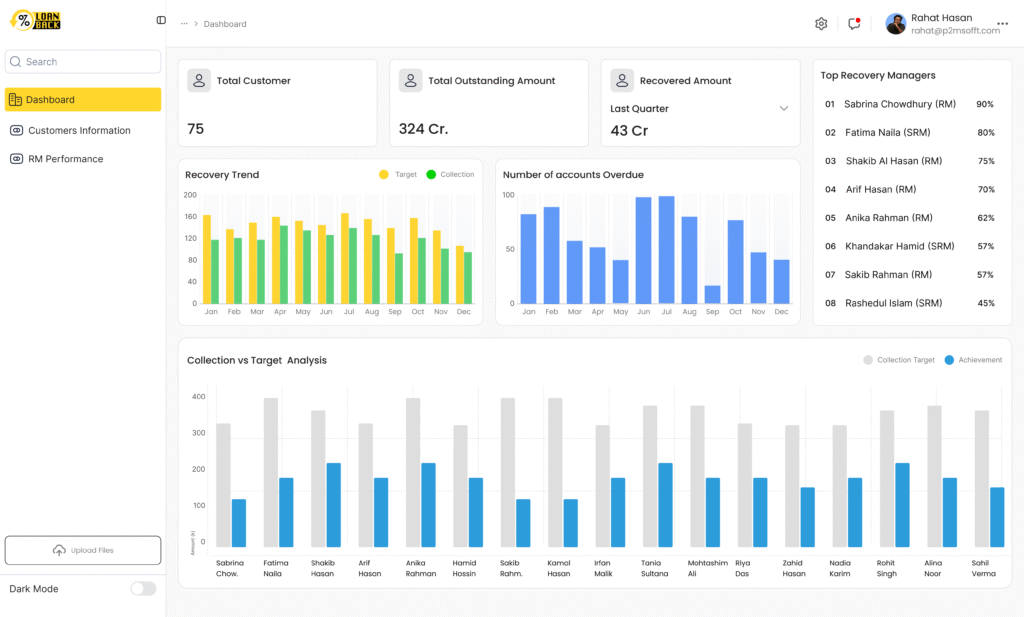

Centralized & user wise dashboard for continuous monitoring of Loan for Retail, SME & Corporate, real-time overdue tracking on the go, DPD, repayment ranking and many more

Performance Monitor, RM efficiency with dashboards, recovery metrics, client follow up logs, and leader boards to boost accountability and result with proper MIS and many more.

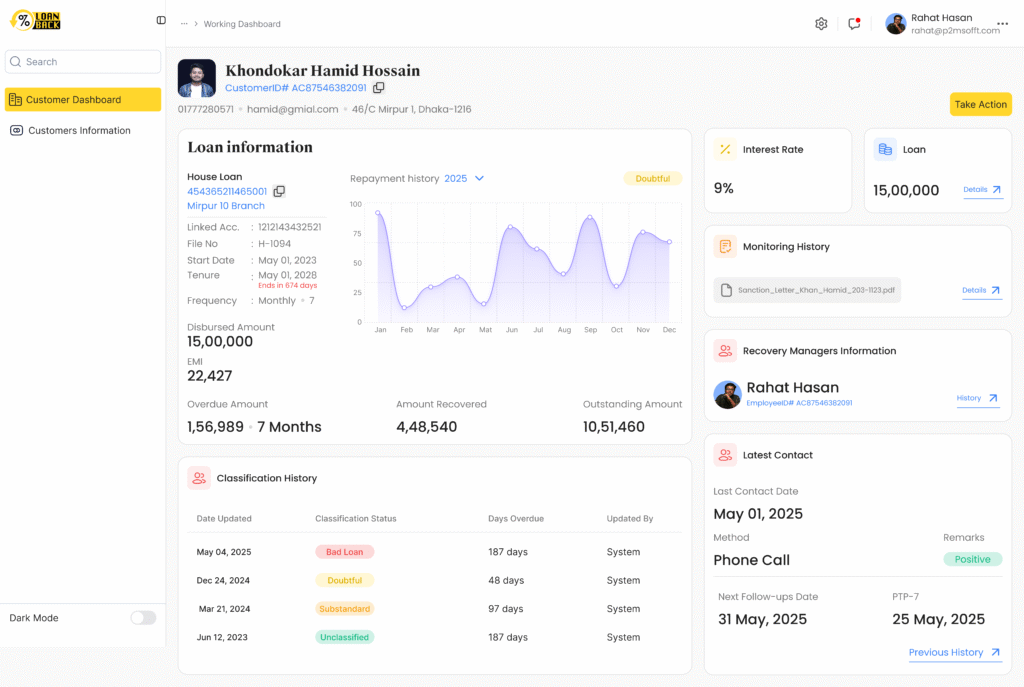

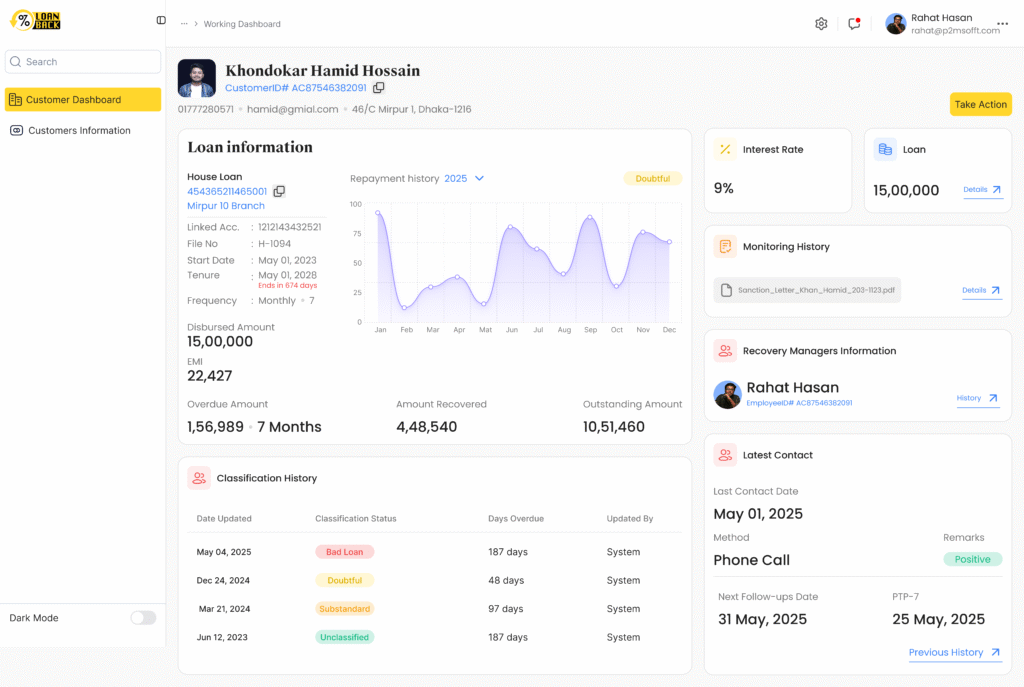

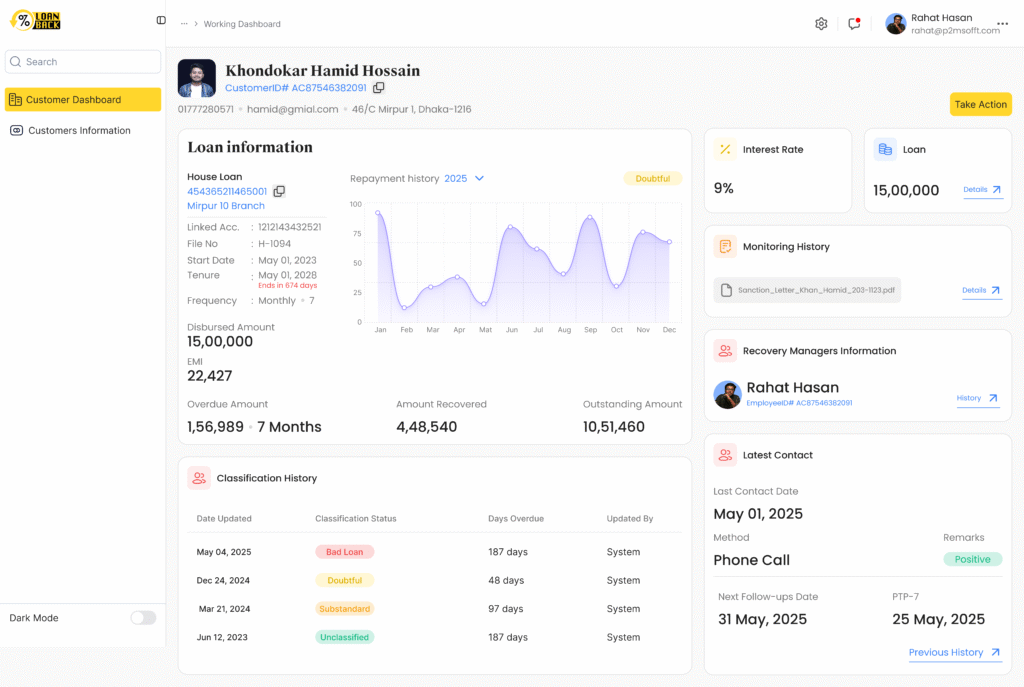

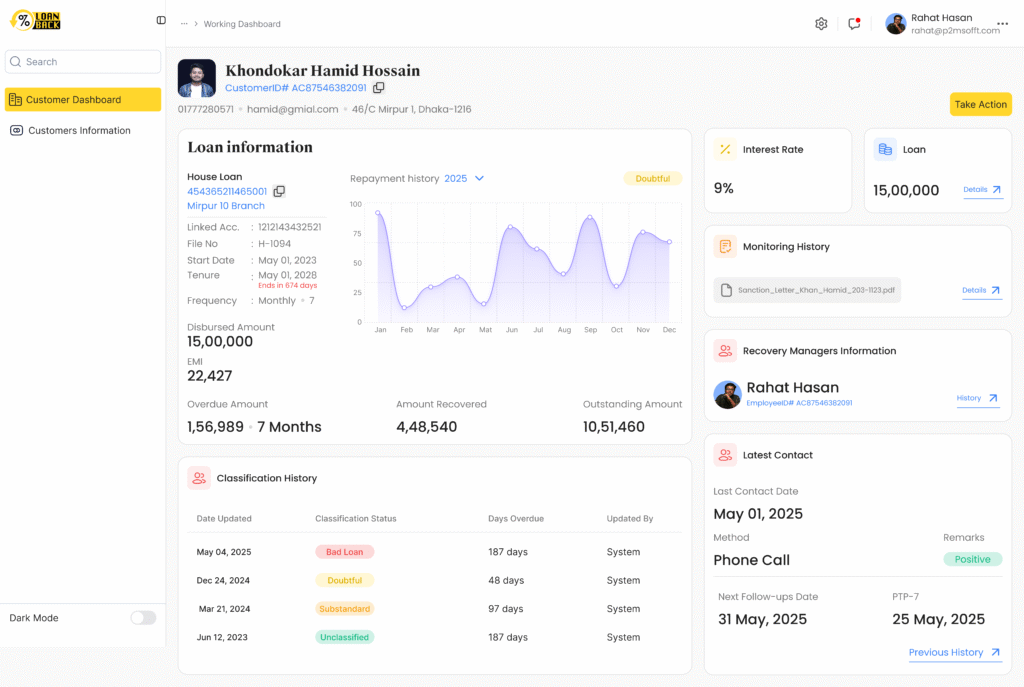

Promise-to-Pay (PTP) & Call Management – Automate client follow-ups with AI-driven reminder and thank-you calls, PTP tracking, and complete call history for disciplined recovery.

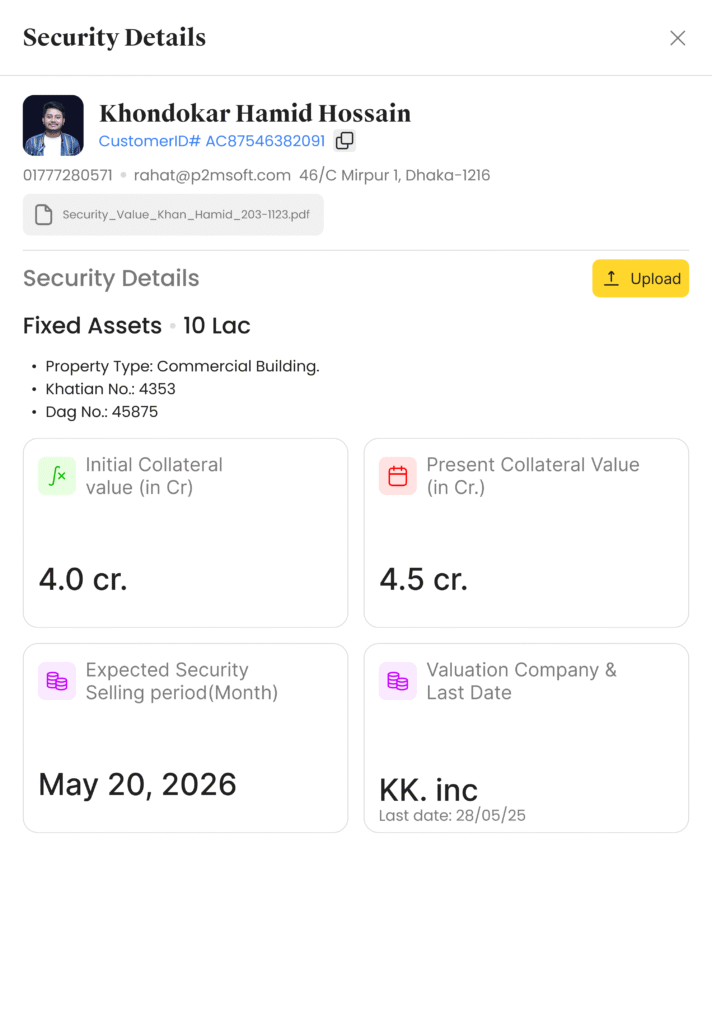

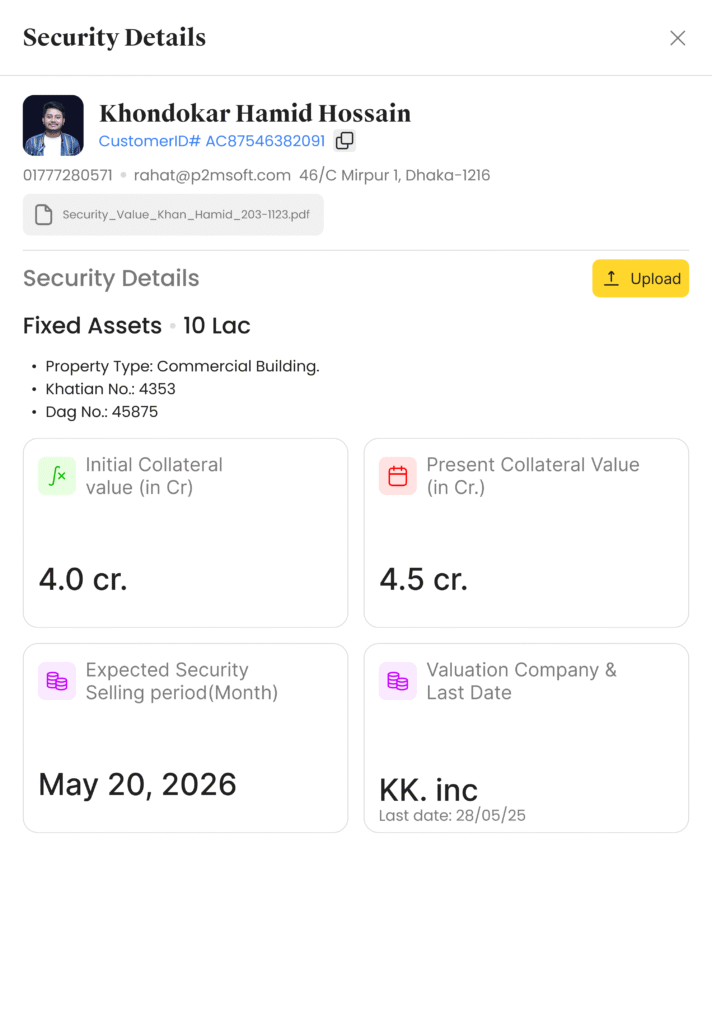

Streamline NPL escalation with legal checklists, automated board memos, digital case tracking, and collateral-linked recovery, its history & many more.

Get clear insights with easy dashboards, track recovery progress, see overdue trends, create quick, accurate reports with full data records & many more.

Information Management & Documentation – Keep all client info, follow-up history, and loan documents in one place with clear notes, feedback, and digital records for easy tracking.

Mobile App & Integration – Easy to use with secure bulk data uploads, role-based dashboards, smart search tools, and automation that cuts manual work for faster NPL management and many more.

Loan Back is developed for efficient Non-Performing Loan (NPL) management. It automates delinquent loan recovery, enforces repayment discipline, and ensures accountability & regulatory compliance, strong tailored made reporting and analytics — helps bank to reduce loan defaults, starts early monitoring, guides to recover high-risk loans faster and protect banks to maintain healthy portfolio.

Loan Back is developed for efficient Non-Performing Loan (NPL) management. It automates delinquent loan recovery, enforces repayment discipline, and ensures accountability & regulatory compliance, strong tailored made reporting and analytics — helps bank to reduce loan defaults, starts early monitoring, guides to recover high-risk loans faster and protect banks to maintain healthy portfolio.

Automate NPL recovery and maximize repayments.

Manage Non-Performing Loans with full regulatory compliance. Loan Back’s secure platform automates recovery workflows, tracks collateral, and maintains audit-ready records for every high-risk account.

Loan Back is a specialized system for Non-Performing Loan (NPL) management, automating recovery, tracking overdue accounts, engaging clients with AI-driven reminders, and ensuring regulatory compliance to maximize repayments.

Loan Back is complied with Bangladesh Bank Loan classification rules and it enables banks to prioritize high-risk accounts to be monitored efficiently and thus plans recovery efficiently.

Yes. Loan Back is CBS-independent and securely handles data via CSV/Excel uploads, allowing banks to manage NPL recovery without exposing sensitive core banking information.

By using AI-driven Promise-to-Pay reminders, automated follow-up calls, and RM dashboards, Loan Back reduces manual effort, ensures timely client engagement, and speeds up recovery for high-risk NPL accounts.

Yes. Loan Back aligns with Bangladesh Bank NPL classification standards, automates legal escalations, generates audit-ready reports, and tracks collateral to ensure full compliance for NPL management.