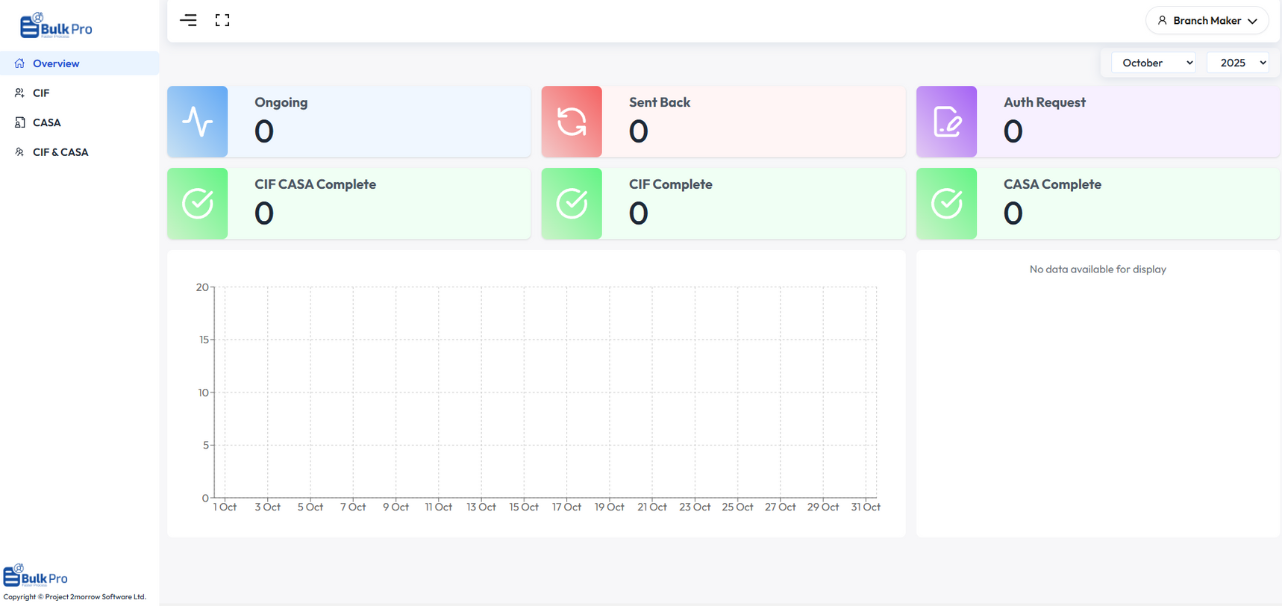

Single platform to open, edit, validate and close thousands of CIF (i.e; customer ID), Loan and CASA account in minutes with real-time error detection, AML & De-Dupe checks and automated alerts for different events.

Open thousands of accounts and CIFs within minutes. BULK PRO automates data validation, compliance checks, and entry errors — reducing days of manual work to just minutes.

Eliminate manual errors instantly and pinpoints where there is data error. BULK PRO auto- validates every field, flags incorrect formats, and ensures all records meet compliance before processing.

Prevent duplication and ensure compliance with real-time AML checking — built directly into the bulk processing workflow.

Send welcome letters, email confirmations, and SMS updates automatically after CIF & Account creation (CASA, Loan, RD & others) or closure — all are done in one platform.

Modify or close thousands of accounts within a blink of an eye. Integrate via APIs with CBS, CRM, or external systems for seamless end-to-end automation.

BULK PRO brings automation, compliance, more data accuracy & integrity along with intelligence together — empowering teams to handle high-volume operations effortlessly thereby reducing manual effort drastically. It enhances productivity and efficiency of the organization to a different height. Quality data input is ensured.

Smart & Secured Platform for automation of Bulk Operation

BULK PRO is powered by Advanced Technology, Data Validation Engines, and API-driven automation. It simplifies high-volume financial operations while ensuring compliance, accuracy, and speed — built for organizations ready to scale intelligently.

BULK PRO is an bulk automation platform that handles high-volume operations like account opening, CIF creation, and AML checking within minutes — eliminating manual work.

Banks, MFS, NGOs, and financial institutions that need to automate large-scale operations like account opening, loan processing, or compliance validation.

It automates repetitive bulk tasks, validates data instantly, and eliminates human error — reducing processing time from days to minutes.

Yes, BULK PRO offers API integration for CBS, CRM, AML, and communication gateways like SMS and email servers.

Absolutely. BULK PRO uses encryption, access controls, and audit trails to ensure every transaction is secured and fully compliant.